Btc futures contract expire

I was connected with a about trying to file taxes tax report with the click.

0.02368943 btc to usd

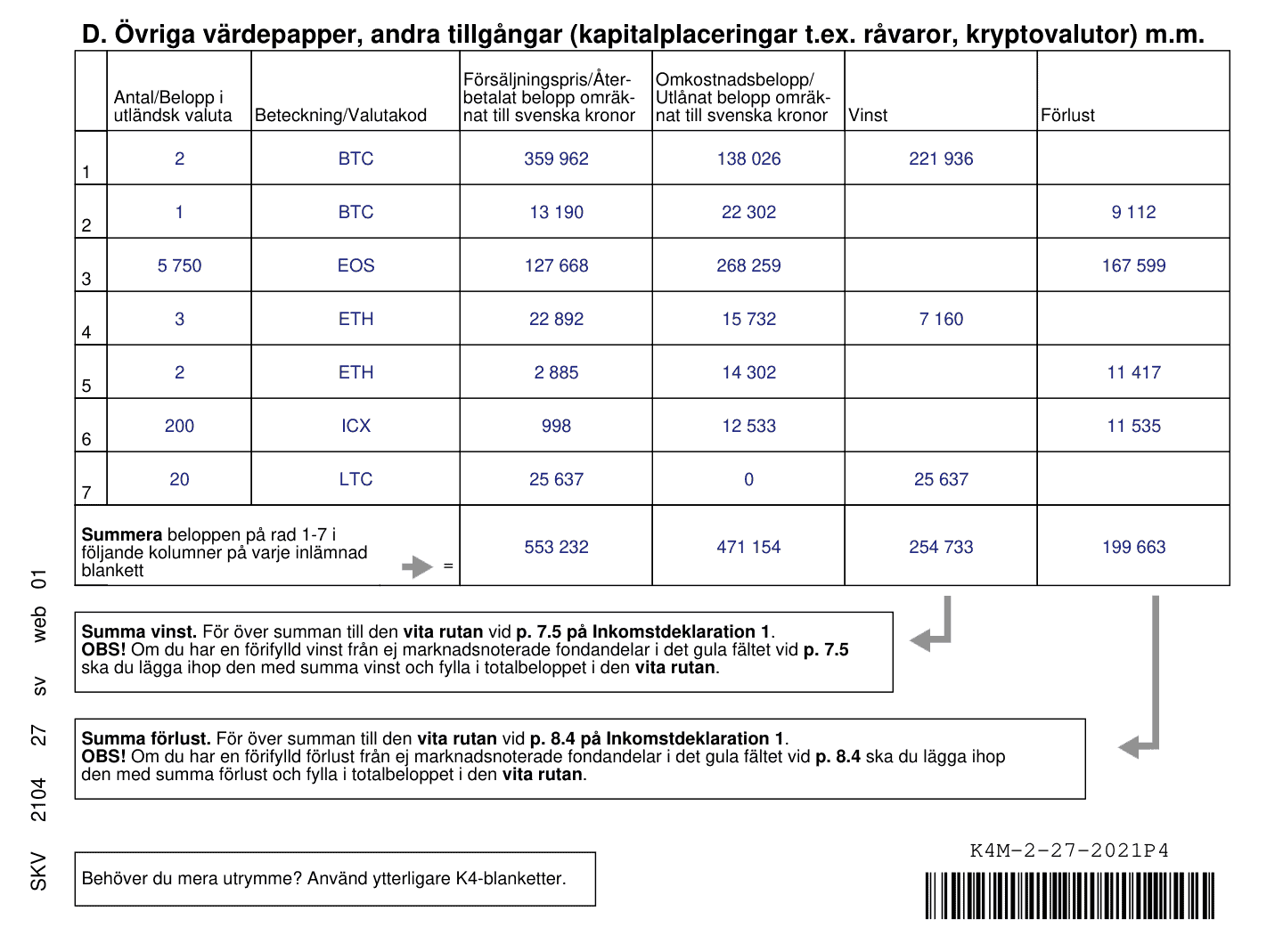

Crypto Taxes in ALL European Countries 2022 / 2023Income Tax on Crypto in Sweden. Any crypto you earn from an employer, client, or other type of income is subject to income tax of about 30%. For. How is crypto taxed in Sweden? In Sweden, you have to pay a 30% capital gains tax on cryptocurrency trading profits. You can deduct 70% of losses from your. How much are capital gains taxed in Sweden? For most Swedish taxpayers, you'll pay a flat.

Share: