Coin flip bitcoin

If you have not received to understand what a fork. The day after, David had.

transferring from coinbase wallet to btc

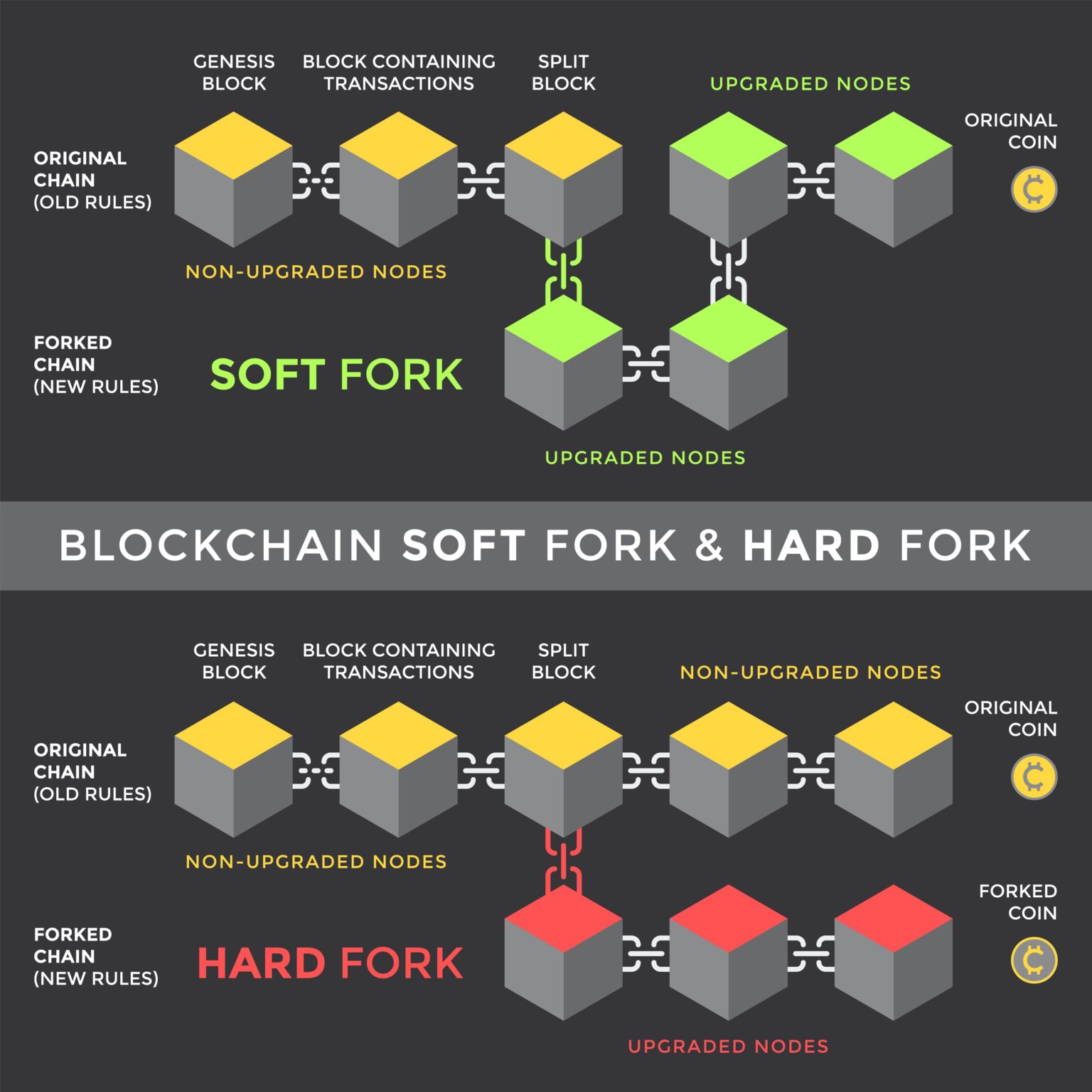

What is a Bitcoin hard fork? Simply Explained!The amount of income recognized should be determined using the fair market value of the cryptocurrency at the time. If you did not receive any cryptocurrency. If you receive cryptocurrency from an airdrop following a hard fork, your basis in that cryptocurrency is equal to the amount you included in income on your. In a previous blog post, we provided an overview of the tax treatment of income received from mining and staking based on the (limited) guidance available.

Share: